- Details

- Category: Press Releases

“The values of the Illinois Holocaust Museum—standing against hatred, prejudice and indifference, and moving toward a better future—are especially relevant during this time of unrest,” said Fine. “I was thrilled to be able view the exhibits and share in this experience with my fellow legislators, as well as show off one of the gems of the 9th District.”

The museum closed its doors in mid-March as a result of the COVID-19 pandemic. To ensure a safe reopening, the museum has introduced strict health and safety measures, including thorough cleaning procedures and temperature screenings for all visitors. Visitors must also wear face masks and purchase tickets online ahead of time.

The museum’s largest display is the Zev and Shifra Karkomi Holocaust Exhibition, which features more than 500 artifacts, documents and photographs from the era of the Holocaust. Visitors can also listen to Holocaust survivors tell their stories through interactive 3D holograms at the Take a Stand Center, named one of the top 12 exhibits in the world by Smithsonian Magazine in 2017.

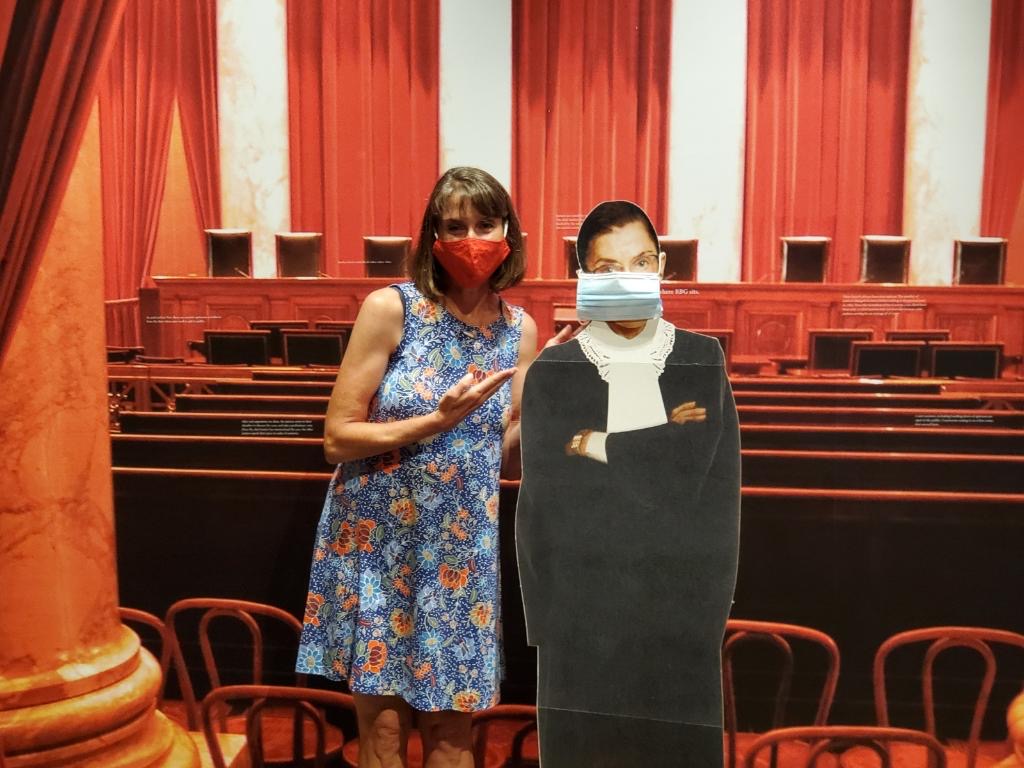

Fine and State Senator Ann Gillespie (D-Arlington Heights) explored the museum’s current special exhibition, Notorious RBG: The Life and Times of Ruth Bader Ginsburg. The exhibition was set to run through Aug. 16, 2020, but has been extended through Jan. 3, 2021.

“The Illinois Holocaust Museum’s Ruth Bader Ginsburg exhibit celebrates her life’s work and commitment to upholding our nation’s values,” Gillespie said. “I was delighted to join the Senate and House Women’s Caucuses for a tour of the museum. With acts of anti-Semitism and white supremacy on the rise, the educational services the museum offers are more important than ever.”

To learn more about the museum, take advantage of virtual programs or reserve tickets, visit www.ILHolocaustMuseum.org.

- Details

- Category: Press Releases

GLENVIEW – As more Illinoisans lean on community organizations for food, shelter and other support, State Senator Laura Fine (D-Glenview) encourages community organizations providing services during the pandemic to contact the Illinois Criminal Justice Information Authority to apply for a portion of $7.1 million in newly approved grants.

GLENVIEW – As more Illinoisans lean on community organizations for food, shelter and other support, State Senator Laura Fine (D-Glenview) encourages community organizations providing services during the pandemic to contact the Illinois Criminal Justice Information Authority to apply for a portion of $7.1 million in newly approved grants.

“As a result of the COVID-19 crisis, more families are struggling with food insecurity, homelessness, mental health and more,” said Fine. “This program offers support to the critical community organizations our friends and neighbors are relying on.”

ICJIA’s Coronavirus Emergency Supplemental Funding Program assists groups that provide support and oversight to a network of community-based organizations. The lead entities may distribute funds via sub-grants or propose a competitive sub-grantee selection process. ICJIA is giving priority to organizations that operate in the areas hardest hit by the pandemic. Grants must be used for housing, supportive services, agency support or food security.

Organizations can find more information and apply for funding here by July 24. ICJIA will notify applicants of their status by Aug. 10.

- Details

- Category: Press Releases

GLENVIEW – To recognize older adults who have contributed to their communities through service, education, the workforce or the arts, State Senator Laura Fine (D-Glenview) invites residents to submit their nominations to the Senior Illinoisans Hall of Fame.

GLENVIEW – To recognize older adults who have contributed to their communities through service, education, the workforce or the arts, State Senator Laura Fine (D-Glenview) invites residents to submit their nominations to the Senior Illinoisans Hall of Fame.

“Especially during this challenging time, it’s important to lift up those special individuals making a difference in our communities,” said Fine. “If you have an older friend, family member or neighbor who deserves recognition for their efforts, I encourage you to nominate them.”

The Senior Illinoisans Hall of Fame celebrates outstanding accomplishments in community service, education, the labor force and the arts. Each year, four candidates—one from each category—are inducted.

Eligibility is based on an individual’s past and present accomplishments, and the candidate must be a current Illinois citizen or a former citizen for most of their life. Posthumous nominees are also considered.

Since its creation in 1994, 121 people have been inducted into the Senior Illinoisans Hall of Fame.

“During the COVID-19 pandemic, many older adults have been stuck in their homes, but that hasn’t stopped them from making an impact on our lives,” said Fine. “Nominating a friend or loved one to the Senior Illinoisans Hall of Fame is a great way to show them you care.”

The Illinois Dept. on Aging has extended the submission deadline through Monday, Aug. 31. Nominations may be submitted online or by calling the Senior HelpLine at 1-800-252-8966.

- Details

- Category: Press Releases

GLENVIEW – To ensure survivors of sexual assault have access to treatment even during a pandemic, State Senator Laura Fine (D-Glenview) is drawing attention to a new law that would allow any federally qualified health center to administer medical forensic exams, also known as rape kits, during a public health crisis like the COVID-19 outbreak.

GLENVIEW – To ensure survivors of sexual assault have access to treatment even during a pandemic, State Senator Laura Fine (D-Glenview) is drawing attention to a new law that would allow any federally qualified health center to administer medical forensic exams, also known as rape kits, during a public health crisis like the COVID-19 outbreak.

“Hospitals are crowded and risky areas right now, which may deter people from seeking care after they have experienced sexual assault,” Fine said. “This law enables survivors to seek justice quickly and safely, even during a public health crisis.”

Senate Bill 557 allows approved federally qualified health centers to perform rape kit examinations and collection during public health emergencies like COVID-19.

“It’s important that we give survivors a safe place to get help,” Fine said. “Expanding treatment options ensures anyone can access the care they need, when they need it.”

The bill was signed into law Friday and took effect immediately.

More Articles …

- Senator Fine: New budget acknowledges need for supportive government services during COVID-19 pandemic

- Senator Fine announces initiative to prepare Illinoisans for careers in information technology

- Senator Fine announces child care centers will reopen with safety guidelines in place

- Secretary of State reopens facilities for new drivers, renewals beginning in June

Page 60 of 75