“Hard working people across the state are struggling to keep up with an increased cost of living,” said Senator Fine (D-Glenview). “The comprehensive plan we passed in the Senate will provide some relief to people across the state.”

Earlier this year, the Illinois Senate passed Senate Bill 157, which provides millions of Illinois taxpayers with financial relief – including direct tax rebates.

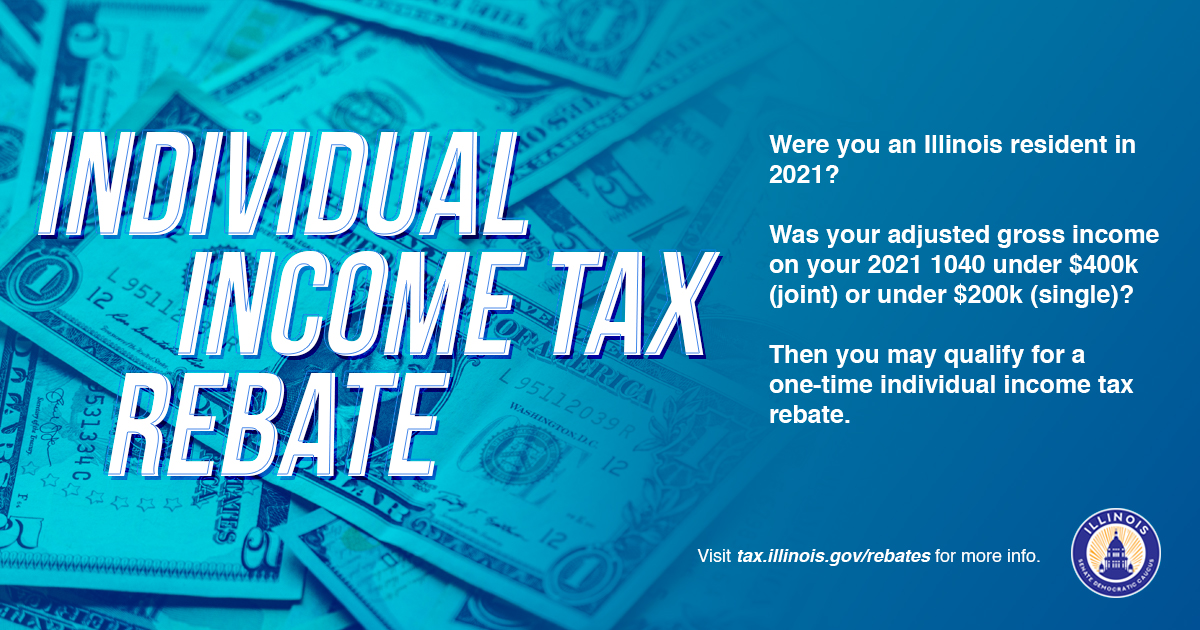

Under the law, people who filed 2021 Illinois taxes are eligible to receive an additional property tax and/or income tax rebate. Individual filers who make less than $200,000 will receive a $50 income tax rebate, and couples who make less than $400,000 will receive $100. Filers are also eligible for $100 per dependent, with a maximum of three.

Additionally, people who paid property taxes in 2021 on their primary residence in 2020 – and make less than $250,000 individually or $500,000 jointly– are eligible for up to $300. The rebate will be equal to the property tax a resident was qualified to claim on their 2021 taxes. People who have already filed taxes will automatically receive their rebate starting as early as this week.

“Illinois families should not have to face these economic difficulties alone,” Fine said. “I am committed to supporting our neighbors during this time. These rebates will help people with everyday expenses, like gas and groceries—which will provide assistance to those struggling with their finances right now.”

For more information on how the funds will be dispersed or to see qualification criteria, people can visit tax.illinois.gov/rebates.